Equity Loan Options: Selecting the Right One for You

Equity Loan Options: Selecting the Right One for You

Blog Article

The Leading Reasons That Property Owners Choose to Protect an Equity Car Loan

For several house owners, choosing to secure an equity funding is a critical economic decision that can offer different benefits. From consolidating debt to taking on significant home restorations, the factors driving people to choose for an equity car loan are varied and impactful (Home Equity Loan).

Financial Debt Debt Consolidation

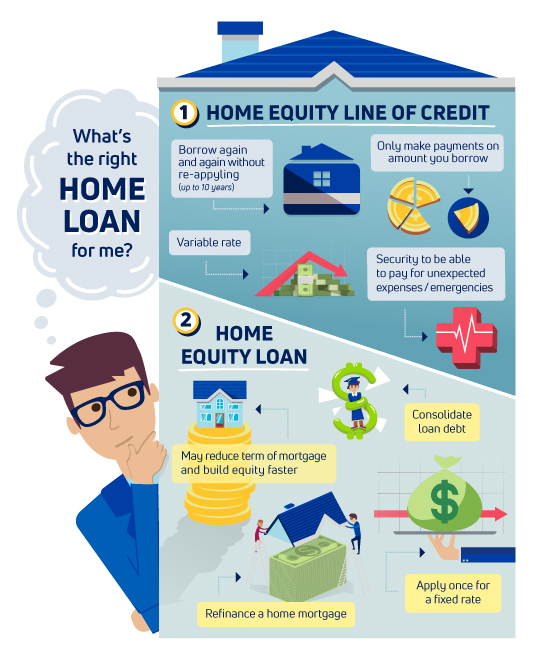

Homeowners often go with protecting an equity car loan as a calculated financial step for financial debt combination. By leveraging the equity in their homes, people can access a swelling sum of money at a lower rates of interest compared to other kinds of borrowing. This capital can then be made use of to repay high-interest financial obligations, such as bank card balances or individual lendings, permitting property owners to streamline their economic responsibilities right into a single, extra manageable regular monthly settlement.

Financial obligation debt consolidation via an equity financing can use numerous benefits to homeowners. The lower interest rate associated with equity fundings can result in substantial expense savings over time.

Home Enhancement Projects

Thinking about the enhanced value and performance that can be attained via leveraging equity, many individuals decide to allot funds in the direction of numerous home renovation projects - Alpine Credits Home Equity Loans. Homeowners often choose to protect an equity loan specifically for refurbishing their homes due to the substantial returns on financial investment that such tasks can bring. Whether it's updating obsolete features, increasing living spaces, or boosting energy effectiveness, home improvements can not just make living spaces much more comfortable however also boost the total value of the home

Common home improvement tasks funded via equity financings include kitchen area remodels, shower room improvements, basement completing, and landscape design upgrades. By leveraging equity for home renovation tasks, house owners can create areas that much better suit their needs and choices while likewise making a sound monetary investment in their residential property.

Emergency Situation Costs

In unpredicted situations where instant financial assistance is required, protecting an equity loan can provide home owners with a sensible option for covering emergency expenses. When unexpected occasions such as clinical emergency situations, urgent home fixings, or unexpected task loss develop, having access to funds via an equity finance can provide a safeguard for property owners. Unlike various other types of borrowing, equity financings normally have lower rates of interest and longer settlement terms, making them an economical alternative for attending to instant financial needs.

Among the key benefits of using an equity financing for emergency situation costs is the speed at which funds can be accessed - Alpine Credits Home Equity Loans. Homeowners can rapidly use the equity developed in their residential or commercial property, allowing them to attend to pressing monetary issues right away. In addition, the versatility of equity loans enables home owners to obtain only what they need, preventing the problem of tackling extreme debt

Education And Learning Financing

In the middle of the quest of higher education and learning, securing an equity lending can function as a calculated monetary source for homeowners. Education funding is a significant issue for numerous households, and leveraging the equity in their homes can supply a method to access required funds. Equity finances frequently use lower rates of interest contrasted to other forms of financing, making them an attractive alternative for funding education and learning costs.

By using the equity accumulated in their homes, homeowners can access significant quantities of cash to cover tuition costs, publications, holiday accommodation, and other relevant expenses. Equity Loans. This can be specifically advantageous for moms and dads seeking to sustain their youngsters through university or individuals looking for to enhance their very own education. In addition, the passion paid on equity finances may be tax-deductible, providing possible monetary benefits for customers

Ultimately, making use of an equity finance for education and learning financing can help people invest in their future earning potential and occupation improvement while successfully handling their monetary obligations.

Investment Opportunities

Conclusion

To conclude, property owners select to safeguard an equity funding for numerous reasons such as financial obligation consolidation, home enhancement tasks, emergency situation expenditures, education and learning funding, and investment opportunities. These financings supply a method for homeowners to accessibility funds for important economic requirements and objectives. By leveraging the equity in next page their homes, homeowners can make the most of lower rate of interest and versatile settlement terms to attain their monetary objectives.

Report this page